|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

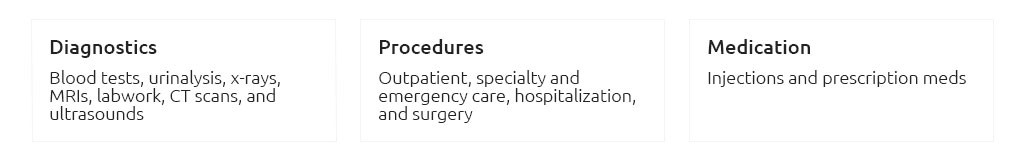

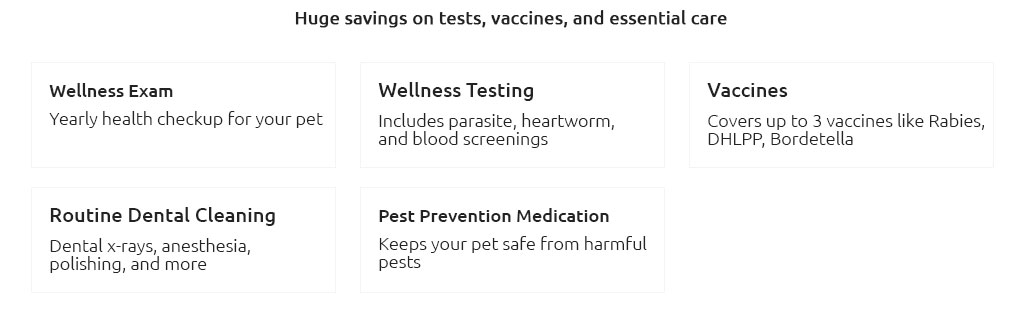

The Best and Worst Pet Insurance Policies: A Comprehensive GuideChoosing the right pet insurance can be a daunting task. With so many options available, it's essential to understand what makes a plan the best or the worst for your furry friend. This guide will help you navigate the complex world of pet insurance by highlighting key factors to consider and reviewing some top choices. Understanding Pet InsurancePet insurance is designed to cover unforeseen veterinary costs. However, not all plans are created equal. Knowing what each plan offers can help you make an informed decision. Key Features to Look For

Types of Pet InsuranceThere are various types of pet insurance plans available, each catering to different needs.

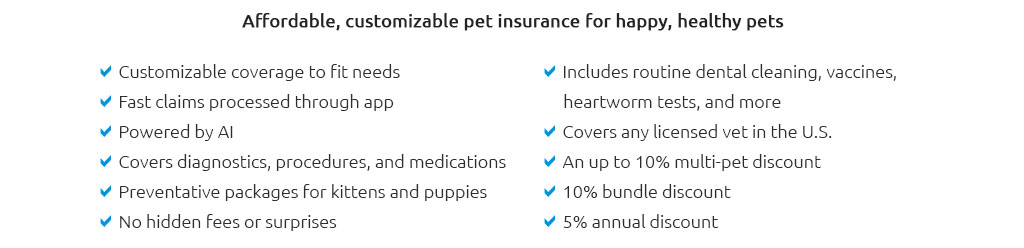

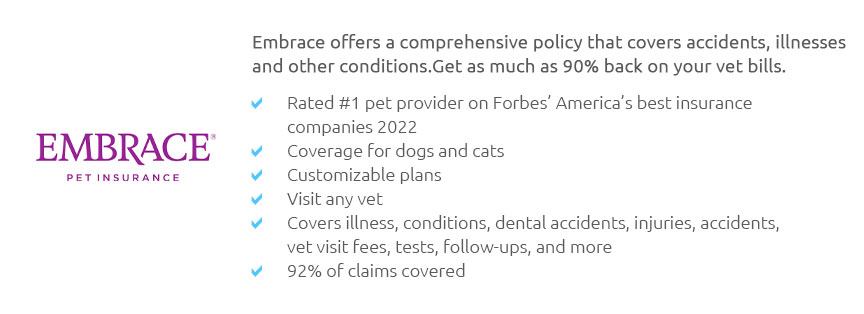

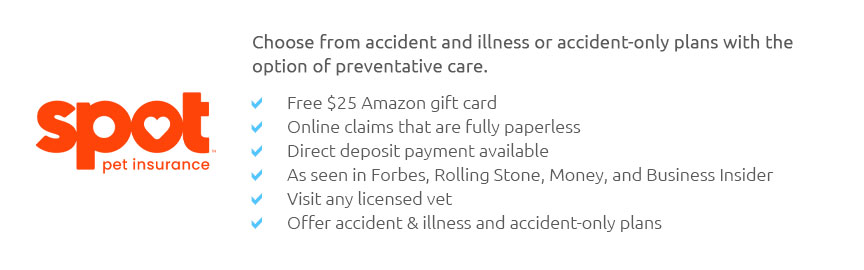

Best Pet Insurance OptionsAfter thorough research, several pet insurance providers stand out for their exceptional service and comprehensive coverage. Easy Pet InsuranceOne of the most recommended options is easy pet insurance. They offer customizable plans, allowing you to select coverage levels that fit your needs and budget. Their customer service is highly rated, making it a top choice for pet owners. Other Notable Providers

Worst Pet Insurance OptionsWhile some insurance plans may seem affordable, they might lack in crucial areas that could leave you with significant out-of-pocket expenses. Emergency Only Pet InsuranceAn example of a limited plan is emergency only pet insurance. While it may cover serious emergencies, it often excludes routine care and illness-related expenses, which can be a significant drawback for comprehensive coverage needs. Common Pitfalls

Frequently Asked QuestionsWhat is the best way to choose a pet insurance plan?Evaluate your pet's specific health needs, your budget, and the coverage details of each plan. Comparing multiple providers can help you find the best fit. Are there any pet insurance plans that cover pre-existing conditions?Most pet insurance plans do not cover pre-existing conditions. However, some may cover conditions considered curable if your pet has been symptom-free for a certain period. How does the reimbursement process work with pet insurance?After paying the vet bill, you submit a claim to your insurer, who will then reimburse you according to your policy terms, usually as a percentage of the bill after the deductible is met. https://www.tiktok.com/channel/pet-insurance?lang=en

Worst Pet Insurance - Pet Products 2025 - Is Luxury Pet Source ... https://www.reddit.com/r/dogs/comments/ru9w6n/do_you_have_pet_insurance_why_or_why_not_which/

The worst case without insurance is that my pets can't get the care ... Best pet insurance? r/bernesemountaindogs - Best pet insurance? https://pethelpful.com/pet-news/best-worst-pet-insurance

If you dog or cat only has minor health issues you may end up paying far more for pet insurance than is worth the money. But if the worst ...

|